Back to news listing

Back to news listing Credit risk management: Choosing the right solution can make all the difference (Part 6/6)

News

![]()

Trade in Asia grew strongly in the first half of 2021 and while its long-term promise may not be in doubt, the latest outbreak of Covid-19 in the region has cast a shadow over the region's near-term growth outlook.

Risks for global trade also abound. There’s the continuing friction between the United States and China, which, along with the pandemic, is contributing to a disruption of long-established global supply chains. And as stimulus programs that propped up economies during the pandemic are eventually scaled back, we can expect a worsening of financial distress and a surge in insolvencies in the next 12 to 18 months across the globe.

The world is also dealing with challenges posed by a changing climate as well as growing income and digital divides between the developed and developing world. While these issues have major implications for the long-term future of global trade, they also have a significant bearing on the credit risks that companies face on a day-to-day basis and must take care to secure their businesses against.

To self-insure or not

Self-insurance is one of several approaches for companies to manage credit risk and many, including in Asia, choose to self-insure for a variety of reasons, including to save costs or retain greater control of their risk management processes, or due to a perceived absence of risk. However, most businesses eventually find that self-insurance is not the most cost-efficient option and has a number of drawbacks.

Taking credit risk management in-house can be a significant expenditure and a drain on company resources that can be better invested in growing the business. Further, with accounts receivables forming a significant component of the balance sheet, companies cannot afford to risk tying up their working capital in unpaid invoices for long periods of time – especially when overdues and write-offs are on the rise, as highlighted by our latest survey on B2B receivables management across Asia.

Additionally, assessing credit risk accurately is a difficult exercise that requires a level of expertise that companies may not possess. For, credit risk assessment is not just about a company evaluating the creditworthiness of every trading partner it does business with - the company must do so while taking into account its own strengths and market position, as well as a range of external influences, such as currency risks and geopolitical risks. As a result, businesses attempting to take on the challenge could either constrain their ability to grow by being excessively cautious about credit limits or expose their business to significant losses by not being careful enough.

Companies don’t need to take this task upon themselves, given the range of options available for them to choose from depending on their operational and transactional requirements. One of the most comprehensive and cost-effective credit risk management solutions is trade credit insurance.

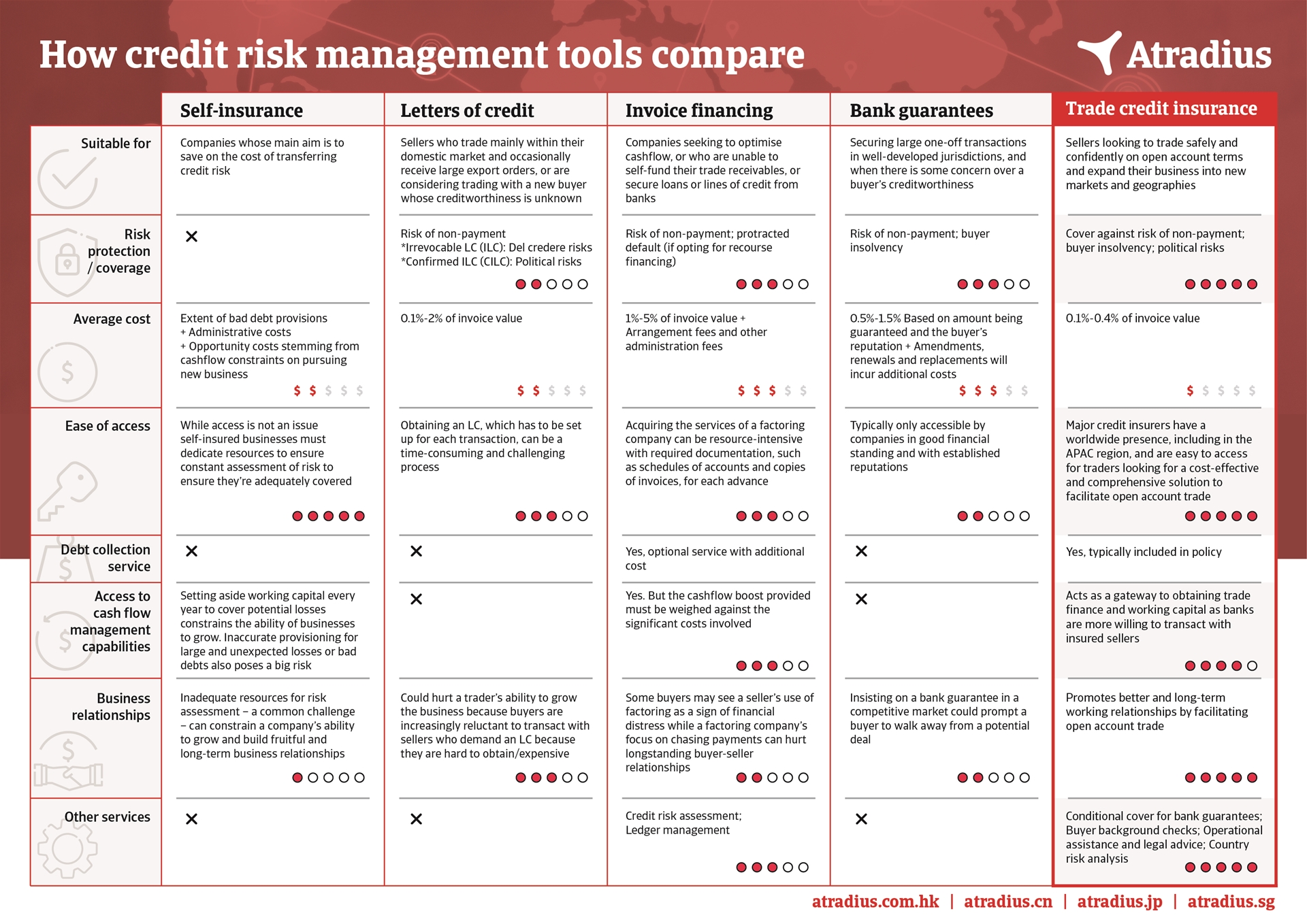

Here we highlight how it compares with other commonly used risk management tools to help you make the right choice.

How credit insurance compares to other options

For many companies, Letters of Credit (LCs) have been the preferred credit management solution for decades. Yet their utility is limited because obtaining an LC for every transaction can be a laborious process while credit insurance covers all eligible transactions. LCs can also be expensive, with charges amounting to as much as 2% of the invoice value compared to an average range of 0.1%-0.4% for credit insurance.

Companies investing in credit insurance also benefit from the insurer’s knowledge and experience of the trading risks involved in their particular industry as well as political risks in the buyer’s country. This enables them to avert or minimise potential losses, and confidently grow their business into new markets and enhance revenues.

Invoice financing is a sensible choice if a seller’s main need is to fund a short-term cashflow gap. Because risk mitigation usually goes hand in hand with improving access to working capital, a combination of invoice financing and credit insurance is typically an appropriate solution.

Such a two-pronged approach is ideal because while invoice financing allows sellers to secure cashflows without waiting weeks for buyers to settle invoices, credit insurance provides greater visibility into the risks involved and protects businesses from default.

Additionally, credit insurance also acts as a gateway to obtaining finance as companies covered by a reputed insurer can expect to be offered higher levels of funding and at better rates, thus potentially reducing their overall cost of financing.

Bank guarantees are usually used to facilitate single, high-value transactions between counterparties that have no previous trading relationship. However, they can be a challenge to acquire as banks typically provide guarantees only to companies in good financial health. Also, bank guarantees do not offer protection against political risks.

Credit insurance offers a complete package of risk assessment, credit protection and debt recovery solutions with policies generally covering up to 90% of the amount owed in respect of commercial risks (protracted default and insolvency) as well as most political risks.

For inclusive coverage, insurers typically recommend whole turnover cover as it applies to a seller's entire trade receivables book, thereby enabling the seller to receive comprehensive protection with a reasonable premium rate, including from financial damages arising due to completely unforeseen circumstances.

Conclusion

In summary, while each of the risk management solutions highlighted here meet specific needs and have their rightful place in global trade, credit insurance is rapidly becoming an essential part of companies’ risk management strategies. For a more detailed understanding of trade credit insurance, click here.

Because, not only does credit risk insurance provide all-round protection as well as access to an insurer’s vast reach and resources in a cost-effective manner, it also helps companies enhance their growth potential by building a better and more durable relationship with their trading partners – a crucial ingredient for success in a rapidly changing global business environment where open account trade is increasingly becoming the norm.

Contact Tokio Marine Insurance Vietnam to understand how credit insurance can help you today!

Email: customerservice.mkt@tokiomarine.com.vn

Hanoi : 024 3933 0704Ho Chi Minh: 028 3822 1340

Trade Credit insurance: Click here for more details.

This article is contributed by Atradius and is subject to their disclaimer here. We partner with Atradius since 2011 to provide trade credit insurance for businesses in Vietnam.

.png) | About AtradiusEstablished in 1925, Atradius is one of the world’s leading providers of trade credit insurance, surety, debt collections and information services. Headquartered in Amsterdam, Atradius provides services worldwide through a strategic presence in more than 50 countries. For more information, please click here. |